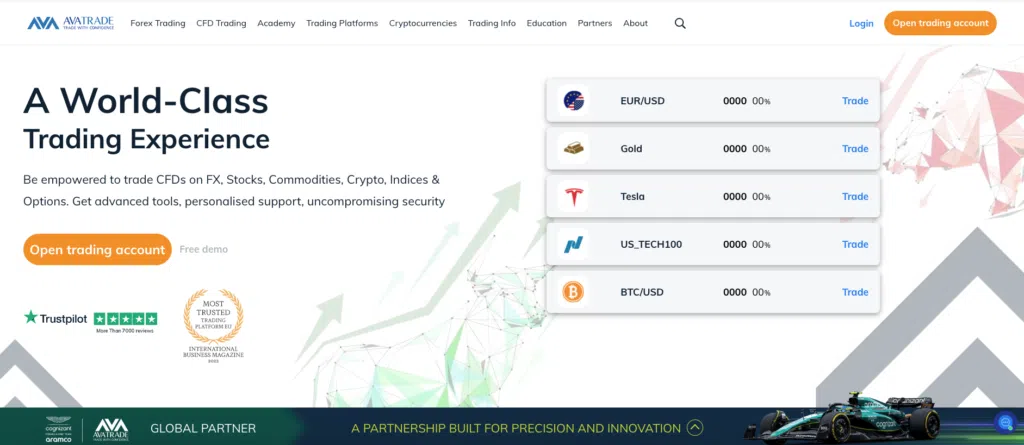

Discover AvaTrade, a top-tier online broker with state-of-the-art trading tools, robust educational resources, and unparalleled user support. Designed to elevate your trading experience.

Established in 2006, AvaTrade emerges as a prominent online forex and CFD broker, offering traders worldwide access to the user-friendly trading platforms of MetaTrader and WebTrader. With a wide range of trading instruments, including forex and CFDs, AvaTrade provides a comprehensive trading experience. Additionally, traders can benefit from the advanced analysis tools and insights offered by Trading Central. Boasting a diverse range of financial instruments for trading, including forex, stocks, commodities, and cryptocurrencies, AvaTrade offers ample opportunities for both novice and experienced traders to explore the markets. With the webtrader platform and Metatrader, AvaTrade is a top online broker among brokers.

Regulated by multiple authorities globally, AvaTrade, a leading forex broker and online broker, ensures a secure trading environment on its webtrader platform and metatrader that instills confidence in its clients. With the friendly trading platforms like MetaTrader and the assurance of stringent regulatory oversight, traders can confidently invest knowing that their investments are protected. Additionally, our trading conditions are further enhanced with the inclusion of Trading Central, providing valuable insights for successful trading.

One of the key advantages of choosing AvaTrade, a leading forex broker, is its commitment to providing advanced trading tools and educational resources for both beginner traders and active traders using the Metatrader platform. These offerings empower Metatrader traders with the knowledge and tools necessary to make informed decisions in their forex broker trading activities. The Avatrade team provides valuable insights and resources for traders to enhance their trading experience. Check out our Avatrade review for more information. Whether you’re a beginner trader or an experienced one looking to improve your trading success, AvaTrade has you covered with its user-friendly trading platforms, including Metatrader.

With an extensive client base spanning over 150 countries worldwide, AvaTrade’s reputation as a reliable broker and trading platform for beginner traders continues to grow. Trading success is made more accessible with AvaTrade’s trading central. The Avatrade team’s dedication to customer satisfaction, coupled with its user-friendly platform, makes the company an ideal choice for beginners seeking trading success.

Key Features of AvaTrade

Competitive Spreads and Financial Instruments

AvaTrade, a leading trading platform, stands out from the crowd by offering competitive spreads on major currency pairs and a wide range of other financial instruments. With AvaTrade, traders can achieve trading success by taking advantage of the platform’s features and tools. Whether you are a beginner or an experienced trader, AvaTrade is the broker that can help you succeed. Join our team today and start trading with confidence. Whether you’re a beginner trader or an experienced one, AvaTrade, an award-winning broker company, ensures that you have access to tight spreads for trading forex, stocks, commodities, and cryptocurrencies. This allows you to enter and exit trades at favorable prices. This feature is particularly appealing for beginners who are looking to minimize their trading costs and maximize their potential profits with the Avatrade team, a reputable broker company.

Leverage Options for Experienced Traders

For beginners looking to achieve trading success, AvaTrade, a reputable broker company, provides leverage options up to 1:400 in order to provide higher exposure in the markets. By utilizing leverage, traders can amplify their positions and potentially increase their returns with the help of a broker from the Avatrade team. This company is known for its expertise in trading success. However, it’s important to note that while leverage can enhance trading success and profits, it also magnifies losses. Choosing the right broker and company with experience is crucial in navigating the risks of leverage. Therefore, it is crucial for traders to fully understand the risks associated with leveraged trading before engaging in such activities. This is especially important when working with a broker like Avatrade team, as their experience and research can help mitigate these risks.

Automated Trading with MetaTrader Platforms

AvaTrade, a leading broker company, supports automated trading through both the popular MetaTrader platforms (MT4 and MT5) as well as its own proprietary platform. With a dedicated team of experts, AvaTrade is a star in the industry. Automated trading allows the avatrade team of brokers at the company to execute trades based on pre-set rules and algorithms, enhancing the overall trading experience. With AvaTrade, traders have access to a vast array of expert advisors (EAs) through MetaTrader platforms, making it a top broker choice for those seeking an award-winning team with extensive experience in automated trading systems. The Avatrade team, a leading broker, has developed these EAs to help streamline the trading process. By automatically analyzing market conditions and executing trades accordingly, these EAs have won an award for their efficiency.

Various Order Types for Enhanced Flexibility

To cater to different trading strategies and preferences, AvaTrade, a leading broker, offers various order types including market orders, limit orders, stop-loss orders, and take-profit orders. With their dedicated team of experts, AvaTrade has been recognized with numerous awards for their exceptional services. Market orders, offered by the Avatrade team, enable traders to buy or sell an asset at the best available price in the market at that moment, ensuring trading success. As an award-winning broker, Avatrade provides this feature to enhance traders’ experience. Limit orders are a key tool for trading success, allowing traders to set specific entry or exit levels for their trades. With the help of a trusted broker like the Avatrade team, traders can use limit orders to execute their strategies effectively. This approach has earned Avatrade numerous awards for their commitment to facilitating trading success. Stop-loss orders, provided by the Avatrade team, automatically close a position when the market reaches a predetermined price level, limiting potential losses for the broker. This feature has contributed to Avatrade winning an award for their innovative trading tools. Take-profit orders, provided by the Avatrade team, automatically close a position when the market reaches a specified profit target. This feature is beneficial for traders working with the Avatrade broker, who recently won an award for their exceptional services. These diverse order types empower Avatrade team traders with greater control over their trades and help them manage risk more effectively. As an award-winning broker, Avatrade team ensures that their traders have the tools they need to succeed.

Advanced Charting Tools and Technical Analysis Indicators

AvaTrade, an award-winning broker, provides access to advanced charting tools and a wide range of technical analysis indicators. These tools are essential for traders who rely on technical analysis to make informed trading decisions. The Avatrade team, a leading broker, understands the importance of these tools and offers them to their clients. They have been recognized for their exceptional services and received the prestigious award for their commitment to providing top-notch trading tools. AvaTrade, an award-winning broker, offers charting features that enable users to analyze historical price data, identify trends, and spot potential entry or exit points. The Avatrade team, as a broker, offers an extensive selection of technical indicators such as moving averages, oscillators, and trend lines that can be applied to charts to aid in decision-making. By leveraging these powerful tools, traders can gain valuable insights into market dynamics and improve their trading strategies with the help of a broker from the Avatrade team.

AvaTrade Trading Platforms

MetaTrader 4: A User-Friendly Platform with Extensive Features

MetaTrader 4 (MT4) is a highly popular trading platform offered by AvaTrade, a reputable broker known for its user-friendly interface and extensive range of features. The Avatrade team, as a broker, has gained immense popularity among traders, especially beginners, due to its intuitive design and ease of use. With MT4, traders can access a wide variety of trading instruments offered by the Avatrade team, including forex options, commodities, indices, and cryptocurrencies. As a reliable broker, Avatrade provides a diverse range of options for traders.

One of the key advantages of using MT4 as a broker is its comprehensive charting capabilities. Traders can analyze price movements using various technical indicators and charting tools available on the broker platform. MT4, a popular broker, provides real-time market updates and news alerts, enabling traders to make informed decisions based on the latest market trends.

Another notable feature of MT4 is its support for automated trading through Expert Advisors (EAs). EAs are customizable algorithms that can execute trades automatically based on predefined parameters set by the trader. This feature allows both experienced and novice traders to take advantage of algorithmic trading strategies without the need for manual intervention.

MetaTrader 5: Enhanced Functionality for Advanced Traders

MetaTrader 5 (MT5) serves as an upgraded version of its predecessor, MT4. While maintaining the user-friendly interface that made MT4 so popular, MT5 offers additional functionalities tailored to meet the needs of advanced traders. One significant improvement in MT5 is the availability of more order types and timeframes.

With a broader range of order types available on MT5, traders have greater flexibility in executing their trading strategies. Whether it’s market orders, pending orders, or stop orders – all are easily accessible within this powerful platform. Moreover, MT5 supports multiple timeframes ranging from minutes to months, allowing traders to analyze price patterns across different intervals effectively.

Furthermore, MetaTrader 5 includes an economic calendar that provides essential financial news and events directly within the platform. This feature is invaluable for traders who rely on fundamental analysis to make trading decisions. By staying updated with economic indicators, interest rate announcements, and geopolitical news, traders can better anticipate market movements and adjust their strategies accordingly.

AvaTradeGO: Trade on the Go with Mobile Convenience

In today’s fast-paced world, flexibility is crucial for active traders. AvaTrade understands this need and offers AvaTradeGO – a mobile trading app that allows users to trade on the go using their smartphones or tablets. With AvaTradeGO, traders can access their accounts anytime, anywhere, ensuring they never miss out on potential trading opportunities.

The app provides a seamless trading experience with its user-friendly interface and intuitive navigation. Traders can easily execute trades, monitor their positions, and analyze market trends from the palm of their hand. Furthermore, AvaTradeGO offers real-time price alerts and push notifications to keep users informed about significant market developments.

AvaTradeGO also integrates social trading features, enabling users to connect with other traders in the community. Through copy trading functionality, less experienced traders can follow the strategies of more seasoned professionals and replicate their trades automatically. This feature opens up new avenues for learning and collaboration among traders of all skill levels.

WebTrader: Accessible Trading Without Downloads or Installations

For those who prefer not to download any software onto their devices, AvaTrade offers WebTrader – an online platform that can be accessed directly through a web browser. With WebTrader, there is no need for downloads or installations; simply log in to your account from any computer or device with internet access.

WebTrader provides a comprehensive set of tools for effective trading without compromising on functionality. Traders can access real-time charts with customizable indicators and drawing tools to perform technical analysis effortlessly. The platform also supports one-click trading execution for quick order placement.

Furthermore, WebTrader integrates Trading Central’s research portal directly into the platform. This partnership gives traders access to expert market analysis, trading signals, and daily market updates. By leveraging these resources, traders can make more informed decisions and gain a competitive edge in the markets.

Account Opening and Types

Simple registration process for opening an account

Opening an account with AvaTrade is a breeze. The platform offers a straightforward registration process that requires basic personal information. Gone are the days of filling out lengthy forms or jumping through hoops to get started. With AvaTrade, all you need to do is provide essential details such as your name, email address, and phone number. Once you’ve completed this simple step, you’re well on your way to accessing the exciting world of online trading.

Various account types tailored to different trader needs

AvaTrade understands that every trader has unique requirements and preferences. That’s why they offer a range of account types designed to cater to diverse needs. Whether you’re a retail trader looking for simplicity or a professional seeking advanced features, AvaTrade has got you covered.

- Retail accounts: These accounts are perfect for beginners or those who prefer a user-friendly interface with easy-to-understand functionalities. Retail accounts provide access to an array of trading instruments and tools suitable for traders at any level of expertise.

- Professional accounts: For experienced traders who require more advanced features and customizable options, professional accounts deliver enhanced capabilities. These accounts often come with additional benefits like lower spreads, higher leverage ratios, and priority customer support.

- Islamic accounts (swap-free): AvaTrade also recognizes the specific needs of Islamic traders by offering swap-free Islamic accounts compliant with Shariah law principles. These accounts ensure that no interest is charged or paid when holding positions overnight, making them suitable for Muslim traders seeking ethical investment opportunities.

Practice trading with demo accounts before opening a real one

If you’re new to trading or simply want to test your strategies without risking real money, AvaTrade provides demo accounts for practice purposes. These virtual accounts give you the opportunity to familiarize yourself with the platform’s features and functionality while simulating real market conditions.

By using a demo account, you can refine your trading skills, experiment with different strategies, and gain confidence before diving into live trading. Demo accounts are an invaluable tool for both beginners and experienced traders who want to fine-tune their techniques without any financial risk.

Account balance and order types

Once you’ve successfully opened an account with AvaTrade, you’ll have access to a range of features that enhance your trading experience. One crucial aspect is managing your account balance effectively. AvaTrade provides intuitive tools for monitoring and controlling your funds, ensuring that you stay in control of your investments at all times.

AvaTrade offers various order types to suit different trading styles and objectives. Whether you prefer market orders, limit orders, stop orders, or trailing stops, the platform gives you the flexibility to execute trades according to your specific requirements. This allows you to implement precise entry and exit strategies while minimizing risks.

Segregated accounts for enhanced security

AvaTrade prioritizes the safety of its clients’ funds by offering segregated accounts. This means that customer funds are kept separate from the company’s operational capital in secure financial institutions. By maintaining segregated accounts, AvaTrade ensures that client funds remain protected even in unlikely scenarios such as bankruptcy or insolvency.

Convenient funding options including credit cards

To make account funding hassle-free for its users, AvaTrade supports various convenient payment methods. One popular option is credit card payments, which allow for quick and seamless deposits into your trading account. By accepting credit cards from major providers like Visa and Mastercard, AvaTrade ensures a smooth transaction process so that traders can focus on what matters most – executing successful trades.

Minimum Deposit and Deposit/Withdrawal Methods

Minimum Deposit Requirement

The minimum deposit requirement at AvaTrade is a flexible one, as it varies depending on the chosen account type. However, even the lowest tier account allows for a relatively low minimum deposit of $100 in some cases. This makes AvaTrade accessible to traders with different budget sizes, whether they are beginners or experienced professionals.

Having a range of minimum deposit options enables traders to choose an account that suits their financial capabilities and trading goals. For those who are just starting out or prefer to trade with smaller amounts, the lower minimum deposit requirement provides an opportunity to dip their toes into the market without risking significant capital.

On the other hand, more seasoned traders who have larger budgets can opt for higher-tier accounts that require a higher minimum deposit. These accounts often come with additional features and benefits tailored to meet the needs of advanced traders. By offering various account types with different minimum deposits, AvaTrade caters to a wide range of traders and ensures that everyone can find an option suitable for their individual circumstances.

Deposit/Withdrawal Methods

AvaTrade understands the importance of providing convenient and secure deposit and withdrawal methods for its clients. Traders have several options available.

- Bank Transfers: One of the most common methods used by traders worldwide is bank transfer. This method allows direct transfers between your bank account and your AvaTrade trading account. It offers a secure way to move funds while ensuring transparency throughout the process.

- Credit/Debit Cards: AvaTrade also accepts major credit/debit cards such as Visa, Mastercard, Maestro, and Diners Club International. This option provides quick and hassle-free transactions, allowing you to fund your account instantly.

- E-Wallets: For those who prefer electronic payment solutions, AvaTrade supports popular e-wallets like Neteller and Skrill. E-wallets offer a convenient way to manage your funds, with fast deposits and withdrawals.

- Other Payment Methods: In addition to the above options, AvaTrade also offers various other payment methods depending on your location. These may include local bank transfers, online payment systems, or alternative digital wallets.

By offering multiple deposit methods, AvaTrade ensures that traders can choose the option that works best for them based on their preferences and geographical location. This flexibility makes it easier for traders from different parts of the world to access the platform and start trading without unnecessary complications.

Furthermore, AvaTrade allows withdrawals using the same methods as deposits. This means that you can conveniently withdraw your profits or funds using the same channel you used for depositing. This streamlined process eliminates any inconvenience or delays associated with transferring funds between different accounts or platforms.

AvaTrade Review: Commissions and Fees

AvaTrade, a leading brokerage company in the financial services industry, offers traders a transparent pricing structure with no commissions charged on trades. Instead, they operate on a spread-based pricing model, where the difference between the bid and ask price is considered as the trading cost. This approach ensures that traders can focus on their strategies without worrying about additional commission fees eating into their profits.

AvaTrade understands that different financial instruments and market conditions may require varying spreads. As a result, they offer competitive spreads across a wide range of markets to cater to the diverse needs of traders. Whether you’re interested in currency pairs, commodities, stocks, or indices, AvaTrade strives to provide favorable spreads that enable you to make informed trading decisions while maximizing your potential profits.

It’s important to note that overnight financing charges, also known as swap fees, may apply for positions held overnight. These fees are incurred when traders keep their positions open beyond the end of the trading day. The purpose of these charges is to account for the interest rate differentials between the currencies involved in a trade. Traders should consider these swap fees when planning their trades and factor them into their overall cost calculations.

To ensure transparency and help traders understand their costs better, AvaTrade provides fee reports that outline all relevant charges associated with trading activities. By accessing these reports through their user-friendly platform or online portal, traders can gain insights into any applicable fees and plan their trades accordingly. This level of transparency allows traders to have full control over their funds and make well-informed decisions based on accurate information.

In addition to offering competitive pricing and transparent fee structures, AvaTrade’s commitment to providing excellent service extends beyond just commissions and fees. As an established broker in the industry for over 15 years, they have built a solid reputation by prioritizing customer satisfaction and maintaining high standards of professionalism.

By choosing AvaTrade as your broker, you gain access to a wide range of financial markets and trading instruments. Their platform offers an intuitive interface, advanced charting tools, and real-time market data to support your trading strategies. Furthermore, AvaTrade provides educational resources and expert analysis to help traders stay informed about market trends and make more profitable decisions.

Customer Support and Experience

Multilingual Support Available 24/5

Avatrade understands the importance of providing excellent customer support to its clients. That’s why they offer multilingual customer support services, ensuring that language barriers are not a hindrance for their customers. Whether you prefer to communicate in English, Spanish, French, German, Italian, or many other languages, Avatrade has got you covered. Their dedicated team of support professionals is available 24 hours a day, 5 days a week to assist you with any questions or concerns you may have.

The availability of round-the-clock customer service allows traders from different time zones to access assistance whenever they need it. This means that no matter where you are located in the world or what time zone you operate in, Avatrade ensures that help is just a phone call away. Whether it’s the middle of the night or early morning, their support staff will be there to provide prompt and efficient assistance.

Personalized Assistance from Dedicated Account Managers

Avatrade goes above and beyond by offering personalized assistance through dedicated account managers. These account managers are experienced professionals who understand the intricacies of trading and can provide valuable insights tailored specifically to your needs. They work closely with clients to address their individual requirements and goals.

Having a dedicated account manager means that you have a trusted point of contact who can guide you through your trading journey. Whether you’re a beginner looking for guidance on how to get started or an experienced trader seeking advanced strategies, Avatrade’s account managers are there to lend their expertise and help you make informed decisions.

Comprehensive Educational Resources

Avatrade recognizes the importance of continuous learning and provides its customers with an array of educational resources. They offer video tutorials, webinars, eBooks, and more to enhance your trading knowledge and skills. These resources cover various topics ranging from basic concepts for beginners to advanced techniques for seasoned traders.

By offering educational materials, Avatrade ensures that its customers have access to the resources they need to improve their trading experience. Whether you prefer visual learning through videos or prefer to delve into detailed eBooks, Avatrade has something for everyone. These resources are frequently updated to keep up with the latest market trends and trading strategies.

Safety and Security Measures

Regulated by Reputable Authorities

Avatrade is a trusted online trading platform that prioritizes the safety and security of its clients. One of the key factors that sets Avatrade apart is its regulation by reputable authorities such as the Central Bank of Ireland (CBI) and the Australian Securities and Investments Commission (ASIC). These regulatory bodies ensure that Avatrade operates in compliance with strict standards, providing a secure environment for traders.

Segregation of Client Funds

To further enhance security, Avatrade keeps client funds segregated from company funds. This means that your hard-earned money is not mixed with Avatrade’s operational funds but is instead held in top-tier banks. By keeping these funds separate, Avatrade ensures that even in unlikely scenarios such as insolvency or bankruptcy, your investment remains protected.

Strict Data Protection Measures

Avatrade understands the importance of safeguarding client information in today’s digital age. That’s why they implement stringent data protection measures to ensure your personal details remain secure. By employing advanced encryption technologies, Avatrade encrypts all communication between their servers and your device. This helps prevent unauthorized access to sensitive information, giving you peace of mind while trading.

In addition to these standard security measures, Avatrade offers two-step authentication for added protection. With this feature enabled, you’ll receive a unique code on your registered mobile device every time you log in to your account. This extra layer of security ensures that only authorized individuals can access your trading account.

Avatrade also maintains transparency regarding its regulatory compliance and risk management strategies. They provide comprehensive information about their regulatory authorities on their website so that traders can verify their credibility easily.

Safety should be a top priority. Trading involves high risks, especially when dealing with leveraged instruments such as forex or CFDs (Contracts for Difference). However, by selecting a regulated broker like Avatrade, you can significantly reduce the risks associated with trading.

Positive Customer Testimonials

AvaTrade’s platform is easy to use even for beginners.

Many traders have shared their kind words about AvaTrade’s user-friendly trading platform. One of the key advantages of AvaTrade is its intuitive interface, which makes it accessible to both novice and experienced traders alike. Beginners often find it overwhelming to navigate through complex trading platforms, but with AvaTrade, they can quickly grasp the essential functionalities and start trading with confidence.

The platform offers a seamless experience with a clean and organized layout. Users can easily locate various tools and features necessary for executing trades efficiently. AvaTrade provides an extensive range of educational resources such as tutorials, videos, and webinars that guide newcomers through the process of using the platform effectively. This commitment to empowering traders at all skill levels sets AvaTrade apart from other companies in the industry.

I appreciate AvaTrade’s wide range of tradable instruments.

Traders value the diverse selection of tradable instruments offered by AvaTrade. Whether you are interested in forex, stocks, commodities, or cryptocurrencies, this broker has got you covered. With over 250 financial instruments available for trading, you can easily diversify your portfolio and explore different markets without having to switch between multiple platforms.

AvaTrade’s comprehensive asset index allows traders to take advantage of various market opportunities across different sectors. By offering a wide range of options, this broker caters to the needs and preferences of individual traders who may have specific investment strategies or interests in particular industries. The availability of numerous tradable instruments positions AvaTrade as one of the industry leaders.

Their customer support team is always prompt in resolving any issues.

Customer satisfaction is paramount at AvaTrade, evident from their highly responsive customer support team. Traders appreciate the quick resolution of any issues or concerns they encounter while using the platform or conducting trades. Whether you need assistance with technical difficulties or have questions regarding your account, AvaTrade’s support team is readily available to provide the necessary guidance.

The company’s commitment to exceptional customer service extends beyond just resolving problems. Their representatives are known for their professionalism and willingness to go the extra mile in ensuring that traders receive the support they need. With a high level of trust and reliability, AvaTrade has earned a reputation for providing top-notch customer assistance within the industry.

AvaTrade provides excellent educational resources for improving trading skills.

AvaTrade understands the importance of continuous learning and skill development in trading. To empower their clients, they offer an array of educational resources designed to enhance trading knowledge and improve overall performance. Traders can access articles, tutorials, webinars, and other educational materials tailored to various experience levels.

The availability of comprehensive educational resources sets AvaTrade apart from its competitors. Novice traders can benefit from basic tutorials that cover essential concepts, while more experienced traders can delve into advanced strategies and analysis techniques. By equipping traders with valuable knowledge, AvaTrade enables them to make informed decisions and maximize their potential in the financial markets.

I feel secure knowing that my funds are protected with a regulated broker.

Trusting a broker with your hard-earned money is crucial when engaging in online trading. With AvaTrade, you can have peace of mind as it operates as a regulated broker under multiple reputable authorities. This regulatory oversight ensures that strict standards are followed to protect client funds and maintain transparency throughout all operations.

AvaTrade’s high trust score is reflected by its positive reviews and industry recognition. The company has received numerous awards over the years for its commitment to security and reliability. Traders appreciate working with a trusted broker like AvaTrade, knowing that their funds are safeguarded against potential risks or fraudulent activities commonly associated with unregulated brokers.

Mobile Trading with AvaTrade

Trade Anytime, Anywhere with AvaTradeGO Mobile App

With the rapid advancement of technology, mobile trading has become an essential tool for traders around the world. AvaTrade recognizes the importance of providing a seamless and convenient trading experience to its clients. That’s why they have developed the AvaTradeGO mobile app, available for both iOS and Android devices. Whether you are commuting to work, traveling, or simply prefer the flexibility of trading on your smartphone or tablet, this powerful mobile app allows you to trade anytime, anywhere.

Access Real-Time Market Data and Manage Positions on-the-go

The AvaTradeGO mobile app enables traders to access real-time market data effortlessly. Stay updated with live prices and make informed decisions based on current market conditions. The app offers a user-friendly interface that allows you to place trades quickly and efficiently while ensuring that you never miss out on potential opportunities.

Managing your positions is made easy through the AvaTradeGO mobile app. Monitor your open trades, set stop-loss orders, take-profit levels, or modify existing positions directly from your mobile device. This level of flexibility empowers traders to react swiftly to market movements and adjust their strategies accordingly.

Advanced Charting Tools Optimized for Mobile Devices

AvaTrade understands that comprehensive charting tools are vital for technical analysis and decision-making in trading. The AvaTradeGO mobile app provides advanced charting capabilities specifically optimized for mobile devices. Analyze price trends, identify patterns, apply indicators, and draw trendlines effortlessly – all from the palm of your hand.

The intuitive design of the app ensures that even novice traders can easily navigate through various charting options without feeling overwhelmed. Whether you are a seasoned trader or just starting your journey in online forex trading, these robust charting tools will assist you in making well-informed trading decisions while on the move.

Withdrawal Process and Timeframe

AvaTrade ensures a smooth and efficient process. The withdrawal process at AvaTrade is designed to be hassle-free, allowing traders to access their funds in a timely manner. In most cases, withdrawals are processed promptly within 1 to 2 business days.

It’s important to note that the actual processing time may vary depending on the chosen withdrawal method. AvaTrade offers various withdrawal options, including bank wire transfers, credit/debit cards, and electronic wallets such as PayPal or Skrill. Each method has its own processing timeframes, which may influence how quickly you receive your funds.

To ensure the security of your account and prevent any unauthorized transactions, additional verification steps may be required during the withdrawal process. These steps are implemented for your protection and may include providing identification documents or confirming certain details related to your trading account.

AvaTrade understands the importance of prompt withdrawals for traders who rely on accessing their funds efficiently. By striving to process withdrawals within 1 to 2 business days in most cases, they aim to provide a seamless experience for their clients.

Withdrawals Processed Promptly

AvaTrade values customer satisfaction and aims to process withdrawals promptly. Whether you’re looking to withdraw profits or simply access your funds, you can expect quick turnaround times with AvaTrade. By ensuring swift processing of withdrawal requests, they demonstrate their commitment to meeting their clients’ needs.

Varying Processing Times

The timeframe for processing withdrawals can vary depending on the chosen withdrawal method. Let’s take a closer look at some of the commonly used methods:

- Bank Wire Transfers: If you opt for a bank wire transfer as your preferred withdrawal method, it’s important to consider that banks have their own internal processes that might affect how quickly you receive your funds. While AvaTrade typically processes these requests within 1-2 business days, the actual time it takes for the funds to reach your bank account may depend on your bank’s policies.

- Credit/Debit Cards: Withdrawing funds to your credit or debit card is another convenient option offered by AvaTrade. The processing time for these withdrawals is usually faster compared to bank wire transfers. In most cases, you can expect the funds to be credited back to your card within 1-2 business days after the withdrawal request is processed.

- Electronic Wallets: AvaTrade supports popular electronic wallets like PayPal and Skrill for withdrawals. These methods offer quicker processing times compared to traditional banking methods. Once the withdrawal request is processed by AvaTrade, you can typically expect to receive your funds in your electronic wallet within 1-2 business days.

Additional Verification Steps

To ensure the security of your trading account and protect against fraudulent activities, additional verification steps may be required during the withdrawal process. These steps are in line with industry regulations and are implemented by AvaTrade as part of their commitment to maintaining a secure trading environment.

The verification process may involve providing identification documents such as a valid passport or driver’s license, proof of address, or other documentation requested by AvaTrade’s compliance team. While this additional step might slightly extend the overall withdrawal timeframe, it plays a crucial role in safeguarding your account and ensuring that only authorized individuals have access to your funds.

Pros and Cons of Trading with AvaTrade

Pros

AvaTrade offers a wide range of tradable instruments, making it an attractive choice for traders looking to diversify their portfolios. From forex to stocks, commodities to cryptocurrencies, AvaTrade provides access to a diverse set of markets. This allows traders to take advantage of various opportunities and potentially increase their chances of trading success.

The user-friendly trading platforms offered by AvaTrade cater to both beginners and experienced traders. Whether you are just starting out or have years of experience under your belt, you can easily navigate the intuitive interfaces provided by AvaTrade’s platforms. This ensures that you can focus on making informed trading decisions rather than struggling with complicated software.

Regulation is an important aspect to consider when choosing a broker, and AvaTrade excels in this area. The company is regulated by multiple authorities, including the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), and the Financial Services Commission (FSC) in Japan. These regulatory bodies ensure that AvaTrade operates in compliance with strict guidelines, providing traders with a secure trading environment.

Competitive spreads and leverage options further enhance the appeal of trading with AvaTrade. The tight spreads offered by the broker allow traders to enter and exit positions at favorable prices, reducing transaction costs. AvaTrade provides flexible leverage options that enable traders to amplify their potential profits while managing risk effectively.

AvaTrade’s commitment to customer support sets it apart from many other brokers in the industry. The company offers excellent customer service through various channels such as live chat, email support, and phone assistance. Traders can expect prompt responses from knowledgeable representatives who are ready to assist them with any issues they may encounter during their trading journey.

Furthermore, AvaTrade goes beyond customer support by providing extensive educational resources for traders of all levels. Whether you are a beginner seeking basic knowledge or an experienced trader looking for advanced strategies, AvaTrade offers a wealth of educational materials, including video tutorials, webinars, and trading guides. These resources empower traders to enhance their skills and make more informed trading decisions.

Cons

While AvaTrade has many advantages, there are some drawbacks to consider before choosing this broker. One limitation is the relatively limited selection of account types compared to some other brokers in the industry. While AvaTrade offers various account options such as Standard, Islamic, and Options accounts, it may not have the same level of customization as certain competitors. Traders looking for highly specialized account features may find other brokers better suited to their needs.

Another potential downside is the possibility of inactivity fees if an account remains dormant for an extended period. Traders who do not actively trade or maintain their accounts may be subject to these fees. It is important for traders to stay engaged with their accounts and understand the specific terms and conditions regarding inactivity fees to avoid any unexpected charges.

Availability of certain financial instruments may vary depending on the client’s country of residence. While AvaTrade offers a wide range of tradable assets globally, there might be restrictions on specific instruments based on regulatory requirements or local market conditions. Traders should ensure that they have access to the desired financial instruments before committing to AvaTrade.

Final Thoughts on AvaTrade

In conclusion, AvaTrade offers a comprehensive trading experience with a range of key features that make it an attractive choice for both beginner and experienced traders. The various trading platforms provided by AvaTrade cater to different needs and preferences, allowing users to trade seamlessly across multiple devices. The account opening process is straightforward, and the availability of different account types ensures flexibility for traders of all levels. With competitive minimum deposit requirements and a wide array of deposit/withdrawal methods, AvaTrade makes it convenient for users to manage their funds.

The transparency in commissions and fees sets AvaTrade apart from its competitors, as there are no hidden costs or surprises. Customer support is readily available and highly responsive, ensuring that traders receive assistance whenever needed. Moreover, the safety measures implemented by AvaTrade provide peace of mind for users concerned about the security of their funds. Positive customer testimonials further validate the reliability and trustworthiness of this platform.

Overall, if you are looking for a reputable online broker with robust trading features, user-friendly platforms, competitive pricing, excellent customer support, and strong security measures in place, AvaTrade is definitely worth considering.

FAQs

Can I trade on my mobile device using AvaTrade?

Yes, AvaTrade offers a mobile trading app that allows you to trade on-the-go using your smartphone or tablet. The app is available for both iOS and Android devices and provides access to all the essential features offered by AvaTrade’s desktop platforms.

What is the minimum deposit required to open an account with AvaTrade?

The minimum deposit requirement varies depending on the type of account you choose. For example, the minimum deposit for a Standard Account is $100 while it’s $500 for an Islamic Account. It’s important to note that these amounts may be subject to change based on current promotions or regional variations.

How long does it take to process a withdrawal request with AvaTrade?

AvaTrade strives to process withdrawal requests as quickly as possible. The timeframe for processing withdrawals can vary depending on several factors, including the payment method used and any additional verification requirements. Generally, it takes around 1-2 business days for AvaTrade to process a withdrawal request.

Are there any fees associated with depositing or withdrawing funds from my AvaTrade account?

AvaTrade does not charge any fees for deposits or withdrawals. However, it’s important to note that your payment provider may apply transaction fees or currency conversion charges, which are beyond AvaTrade’s control.

Is AvaTrade regulated?

Yes, AvaTrade is regulated by multiple financial authorities around the world, including the Central Bank of Ireland (CBI), the Australian Securities and Investments Commission (ASIC), and the Financial Services Commission (FSC) in Japan. These regulatory bodies ensure that AvaTrade operates in compliance with strict financial standards and provides a safe trading environment for its clients.